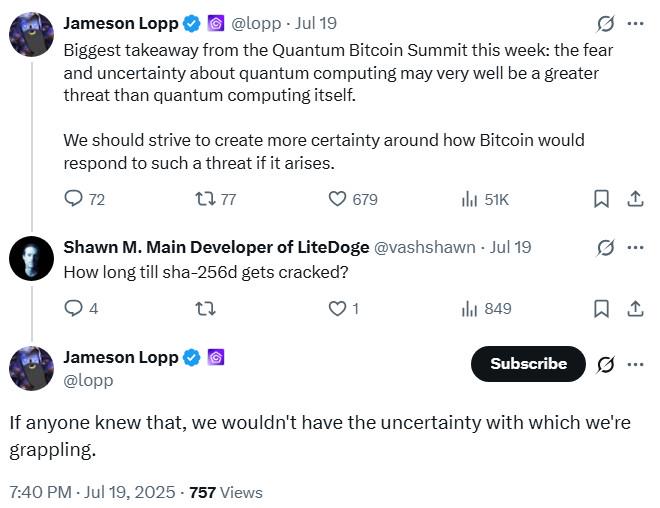

What if quantum computers already broke Bitcoin?

If a quantum computer capable of breaking modern encryption were to come online today, Bitcoin would likely be under attack — and no one would know.

“Everything would look like legitimate access,” David Carvalho, CEO of post-quantum infrastructure company Naoris Protocol, told Cointelegraph. “When you think you’re seeing a quantum computer out there, it’s already been in control for months.”

“You wouldn’t even know,” he said.

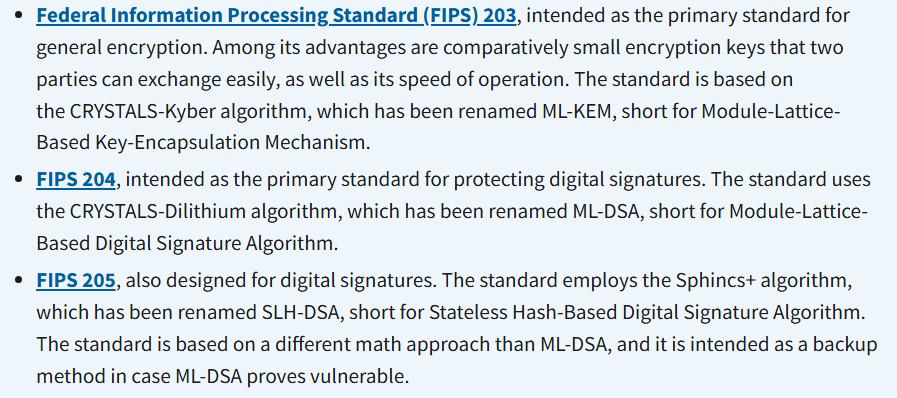

Researchers at IBM, Google and government-backed laboratories are racing to close that gap, but the clock is ticking. The US National Institute of Standards and Technology (NIST) has begun approving post-quantum algorithms, while most public blockchains still rely on encryption designed in the 1980s.

For now, it’s a theoretical threat. But if the theory became reality, Bitcoin’s defenses would crumble faster than the network could react, Carvalho warned.

How a quantum attack could break Bitcoin

Bitcoin’s core security depends on the Elliptic Curve Digital Signature Algorithm, or ECDSA, a cryptographic standard first proposed in 1985. The system allows users to prove ownership with a private key, while only the corresponding public key is visible to the network.

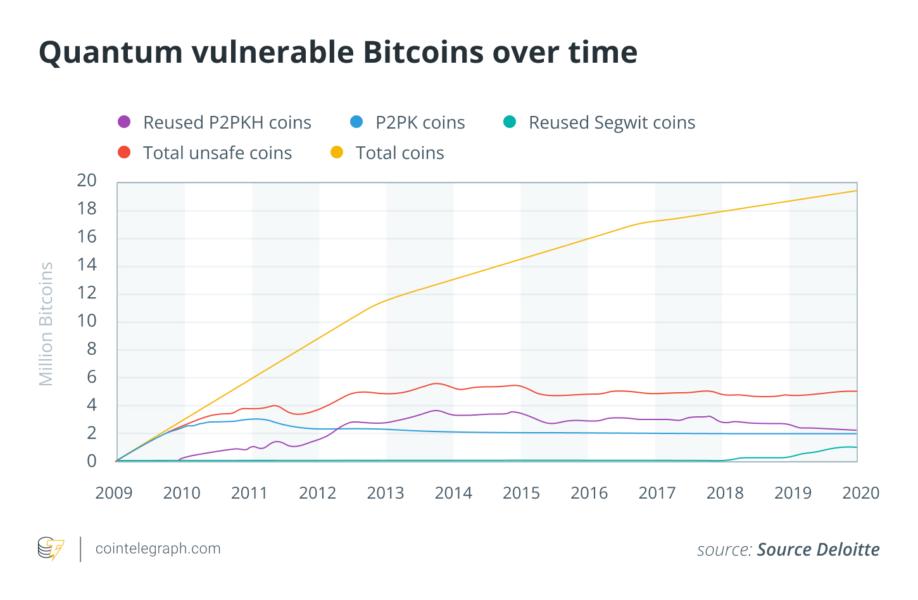

Using Shor’s algorithm, a sufficiently powerful quantum computer could theoretically recover a private key directly from a public one. That would allow attackers to access any wallet where the public key has been exposed onchain, such as those used in early Bitcoin (BTC) transactions.

“It would be impossible to prove a quantum computer did it because it derives legitimate access,” Carvalho said. “You’d just see those coins move as if their owners decided to spend them.”

Kapil Dhiman, CEO and founder of Quranium — a layer-1 blockchain startup focused on post-quantum security — warned that the earliest and most visible victims would be the oldest wallets.

“Satoshi’s coins would be sitting ducks,” he told Cointelegraph. “If those coins move, confidence in Bitcoin will shatter long before the system itself fails.”

In such a scenario, the blockchain would continue processing transactions normally. Blocks would be mined, and the ledger would remain intact, but ownership would have quietly changed hands.

The reality today is that more powerful GPUs and better algorithms make brute-force attacks slightly more efficient. However, ECDSA with Bitcoin’s 256-bit keys is still far beyond the reach of classical computing.

Bitcoin is behind TradFi in post-quantum encryption

While banks, telecom networks and government agencies are already testing post-quantum encryption, most major blockchains still rely on technology from the 1980s.

“All the blockchains have identified this vulnerability as a root cause,” Dhiman said, referring to the risk that current encryption methods like ECDSA could be broken by quantum computers.

Transitioning Bitcoin to a quantum-resistant model would require an overhaul of the network’s consensus rules that demands broad coordination among miners, developers and users.

Researchers have floated early proposals, including Bitcoin Improvement Proposal 360, which outlines potential pathways for adopting new cryptographic schemes, and the “Post Quantum Migration and Legacy Signatures Sunset” proposal, which phases out legacy signature schemes. Ethereum developers have also explored lattice-based signatures and other quantum-resistant options, though none have reached implementation.

In traditional finance, the shift is already underway. The US NIST has approved algorithms, and JPMorgan has tested a quantum-safe blockchain in partnership with Toshiba. SWIFT has started offering post-quantum security training for its network.

“Traditional finance is actually ahead,” Carvalho said. “They have central control, budgets and a single authority that can push upgrades. Crypto doesn’t have that. Everything takes a consensus.”

Some newer blockchain projects are positioning themselves as quantum-ready from inception. Naoris Protocol, led by Carvalho, was mentioned in an independent proposal submitted to the US Securities and Exchange Commission that discussed post-quantum standards, while Dhiman’s Quranium uses the NIST-approved Stateless Hash-Based Digital Signature Algorithm. Meanwhile, Quantum Resistant Ledger is a blockchain built around XMSS hash-based signatures, a now-standardized NIST algorithm.

What happens if Bitcoin fails the quantum test

For the average Bitcoin holder, the primary concern is a sudden collapse in confidence, which could send prices plummeting and ripple through traditional markets, where institutional adoption of cryptocurrencies has been accelerating.

“There is a non-zero probability of it being out now. The consensus in the scientific, research and military communities is that it is not the case,” Carvalho said.

“However, it would not be the first time world-class cryptography had been broken without public knowledge,” he added, referring to the Enigma cipher.

Used by Nazi Germany during World War II, the Enigma cipher was considered unbreakable at the time. But cryptanalysts led by Alan Turing and his team at Bletchley Park quietly cracked it. The Allies kept the breakthrough a secret so that Germany would continue using the cipher.

“When you think you’re seeing a quantum computer, it’s already been in control for months,” Carvalho warned.

But experts remain optimistic that quantum-secure blockchain systems are achievable and that the industry is attempting to align with standards already being adopted in traditional finance.

“Quantum-secure systems are possible,” said Dhiman. “We just need to start building them before the threat becomes real.”

For now, quantum threats remain theoretical. Bitcoin’s encryption holds strong, and computers capable of breaking it exist only on paper.

Content Original Link:

" target="_blank">