Container Shipping Market: Weekly Analysis

The container shipping market exhibited a mix of resilience and volatility this week, with stocks reflecting the impact of global trade flows, fuel costs, and supply-demand imbalances. While some companies managed to post gains, others experienced notable declines due to shifting freight rates and macroeconomic pressures.

This report provides a detailed company-by-company analysis, shedding light on the forces driving each stock’s performance.

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY)

COSCO SHIPPING remained relatively stable throughout the week, trading at $7.66 before edging up slightly to $7.7. The minor uptick suggests resilience in the face of market fluctuations. COSCO’s long-term performance remains tied to demand recovery in Chinese exports, fuel price dynamics, and regional geopolitical factors. Investors are watching closely as the company navigates a complex trade environment.

- ZIM Integrated Shipping Services Ltd (ZIM)

ZIM’s stock saw early gains, rising from $18.43 to $18.88, before experiencing a sharp drop to $17.97 by March 20. The decline reflects ongoing challenges, including high debt levels and softening freight rates. ZIM continues to adjust its fleet strategy to maintain profitability, but the stock remains highly volatile due to market uncertainty and fuel cost fluctuations.

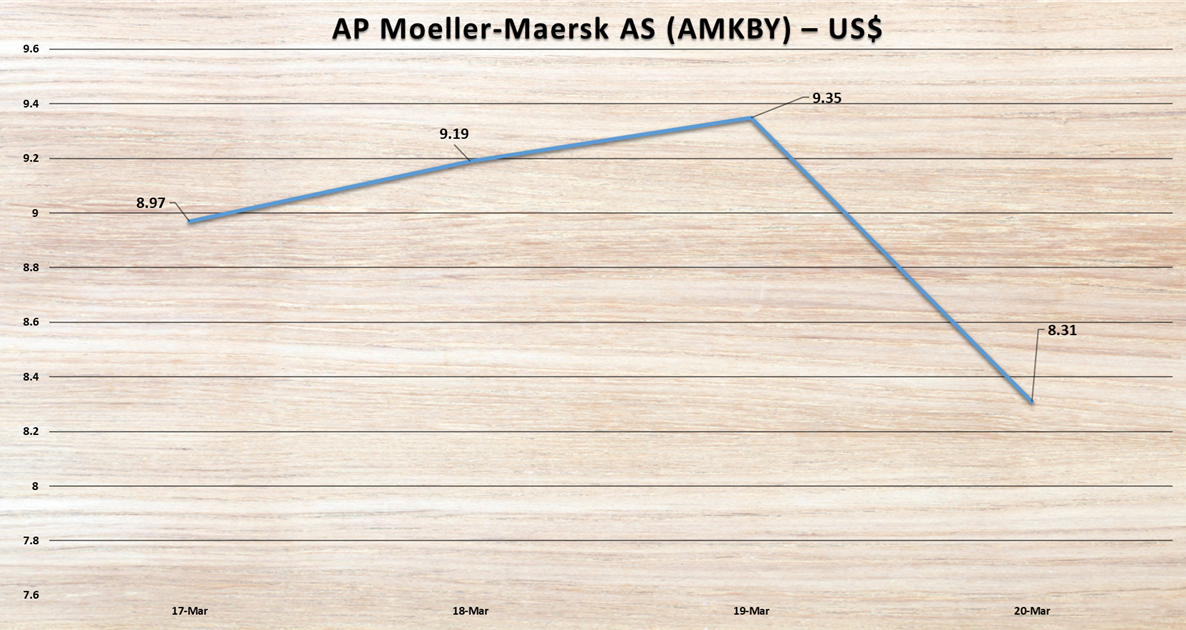

- AP Moeller-Maersk AS (AMKBY)

Maersk showed relative strength early in the week, climbing from $8.97 to $9.35 before retreating to $8.31. The correction reflects continued pressure on shipping rates, particularly on major East-West trade lanes. Maersk’s strategic focus on logistics expansion and decarbonization remains a key long-term narrative for investors.

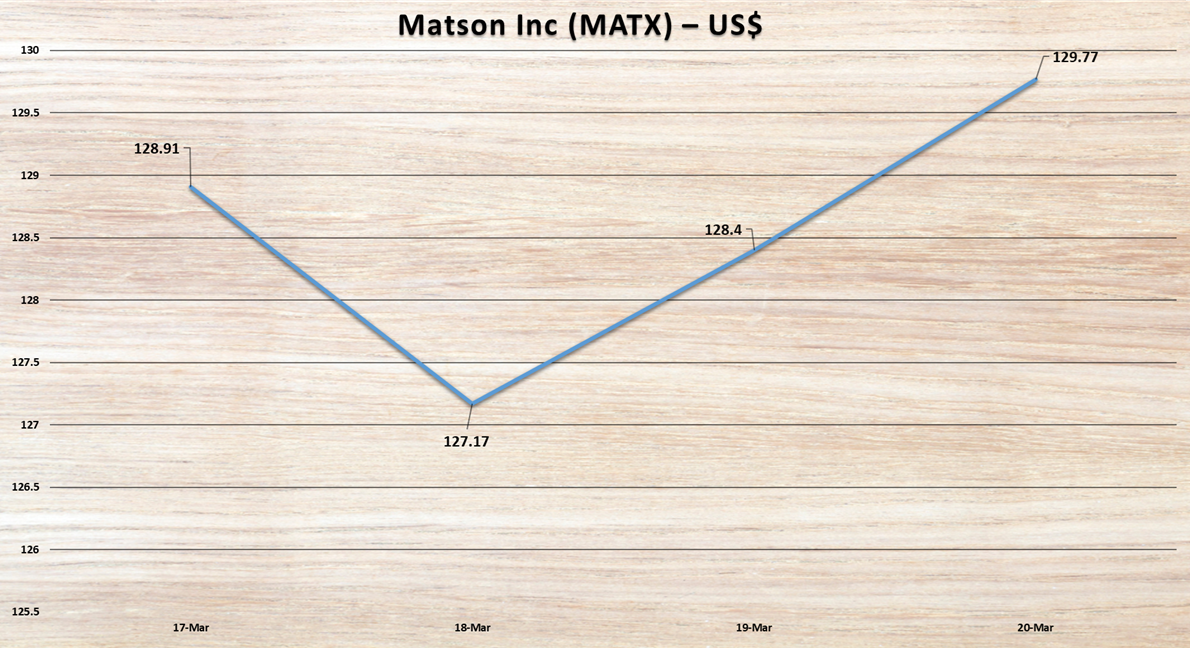

- Matson Inc (MATX)

Matson traded within a tight range, peaking at $129.77 before settling at lower levels. The company benefits from strong transpacific demand but faces cost pressures and cyclical fluctuations. With fuel prices playing a crucial role in profitability, investors are keeping an eye on bunker fuel trends and Matson’s operational efficiency.

- SFL Corporation Ltd (SFL)

SFL saw steady gains, rising from $8.36 to $8.55 before a slight decline to $8.49. As a diversified maritime leasing company, SFL remains relatively insulated from extreme volatility. The company’s exposure to different shipping segments provides some stability amid broader market fluctuations.

- Costamare Inc (CMRE)

Costamare remained on an upward trajectory, climbing from $10.29 to $10.67. Strong charter rates and demand for leased containerships continue to support the company’s fundamentals. Investors are optimistic about Costamare’s ability to maintain profitability amid fluctuating freight conditions.

- Danaos Corporation (DAC)

Danaos experienced moderate gains, moving from $80.01 to $83.67 before a slight correction. The company’s exposure to long-term charters provides revenue visibility, though short-term stock movements reflect broader market sentiment. Investors remain confident in Danaos ability to generate strong cash flows.

- SITC International Holdings Co Ltd (1308)

SITC fluctuated between HK$20 and HK$19.22 before recovering slightly. As an intra-Asia trade specialist, SITC’s performance closely follows regional demand and port congestion levels. The market remains watchful of China’s export trends and potential supply chain disruptions.

- Orient Overseas International Ltd (0316)

OOIL moved between HK$115.3 and HK$117.2 before ending at HK$114.8. The company remains a strong player in the transpacific trade, though it faces pressures from rate adjustments and capacity shifts. Long-term investors are evaluating its ability to sustain profitability as global economic conditions evolve.

- Yang Ming Marine Transport Corp (2609)

Yang Ming saw a steady climb early in the week, moving from NT$75.9 to NT$77.4, before settling lower. The stock continues to be influenced by freight rate adjustments and fuel cost fluctuations. Investors remain cautious as the company navigates shifting market dynamics.

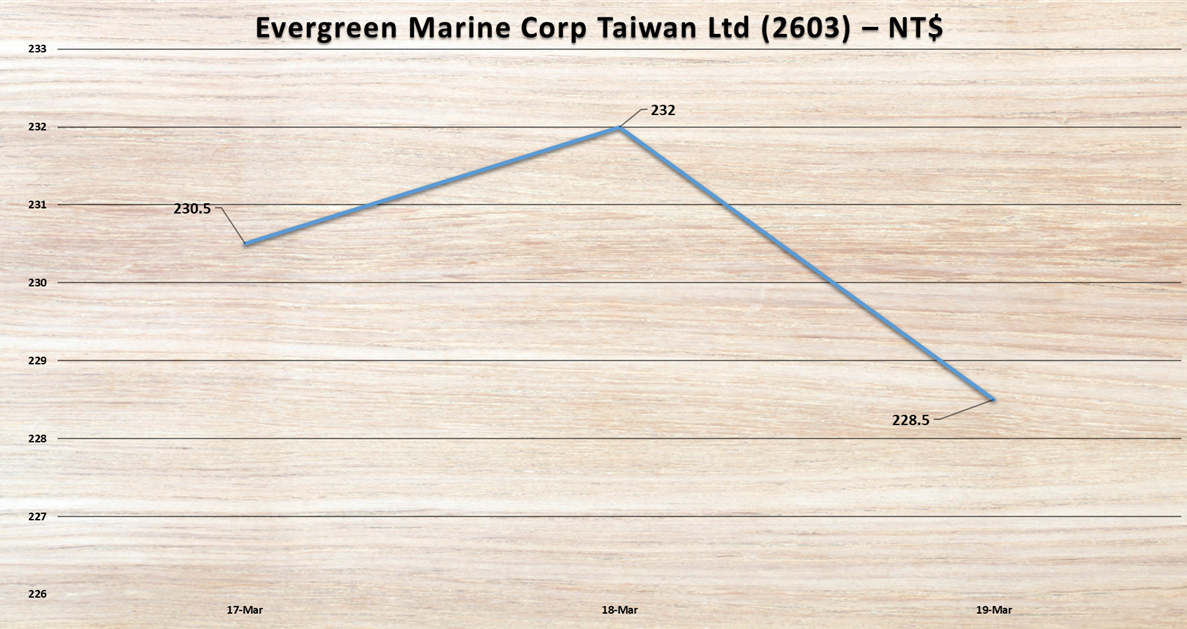

- Evergreen Marine Corp Taiwan Ltd (2603)

Evergreen traded between NT$230.5 and NT$228.5, reflecting the broader market’s stability. Strong demand for containerized goods has helped mitigate some rate declines, but concerns over future capacity management persist.

- Wan Hai Lines Ltd (2615)

Wan Hai experienced some volatility, moving from NT$86.2 to NT$88 before settling at NT$86. The company’s intra-Asia focus provides some insulation from global disruptions, but rate fluctuations continue to impact earnings.

- Hapag-Lloyd AG (HLAG)

Hapag-Lloyd experienced a notable rise in its share price, climbing from €141.7 to €147, before undergoing a correction that brought it down to €132.9. These fluctuations are largely driven by shifts in European shipping demand and ongoing concerns about fuel costs. Despite these market movements, the company continues to maintain a strong position, supported by its robust pricing strategy and ability to adapt to changing industry dynamics.

- National Shipping Co. (4030)

National Shipping Co. (4030) experienced a steady rise in its share price, moving from SAR 29.6 to SAR 31.05, before eventually stabilizing. The company’s performance is bolstered by its strong presence in Middle Eastern trade, which provides a solid foundation for its operations. However, its long-term profitability may face challenges due to potential shifts in the oil market, which could impact demand and operational costs. Despite these uncertainties, National Shipping remains well-positioned within its niche, though it will need to navigate evolving market conditions carefully.

- Pan Ocean Co Ltd (028670)

Pan Ocean’s share price fluctuated within a tight range, reaching a peak of ₩31.05. As a company operating in both bulk and container shipping, Pan Ocean’s performance is closely tied to commodity price movements, which can significantly influence its revenue and profitability. Investors are currently evaluating the company’s long-term growth potential, particularly in light of its ability to adapt to changing market dynamics and its exposure to global trade trends. While the stock has shown stability, its future trajectory will likely depend on broader economic conditions and its strategic response to industry challenges.

- MPC Container Ships ASA (MPCC)

MPC’s share price traded within a relatively steady range, experiencing only minor fluctuations during the period. The company’s leasing strategy has been a key factor in providing financial stability, helping to cushion it against some market volatility. However, broader macroeconomic uncertainty, including concerns about global economic growth and shifting trade dynamics, continues to weigh on investor sentiment. While MPC’s business model offers a degree of resilience, its performance in the near term may be influenced by external economic factors and the overall health of the shipping and logistics sector. Investors remain cautious as they monitor how the company navigates these challenges.

- Mitsui O.S.K. Lines, Ltd. (9104)

- Kawasaki Kisen Kaisha, Ltd. (K-Line)

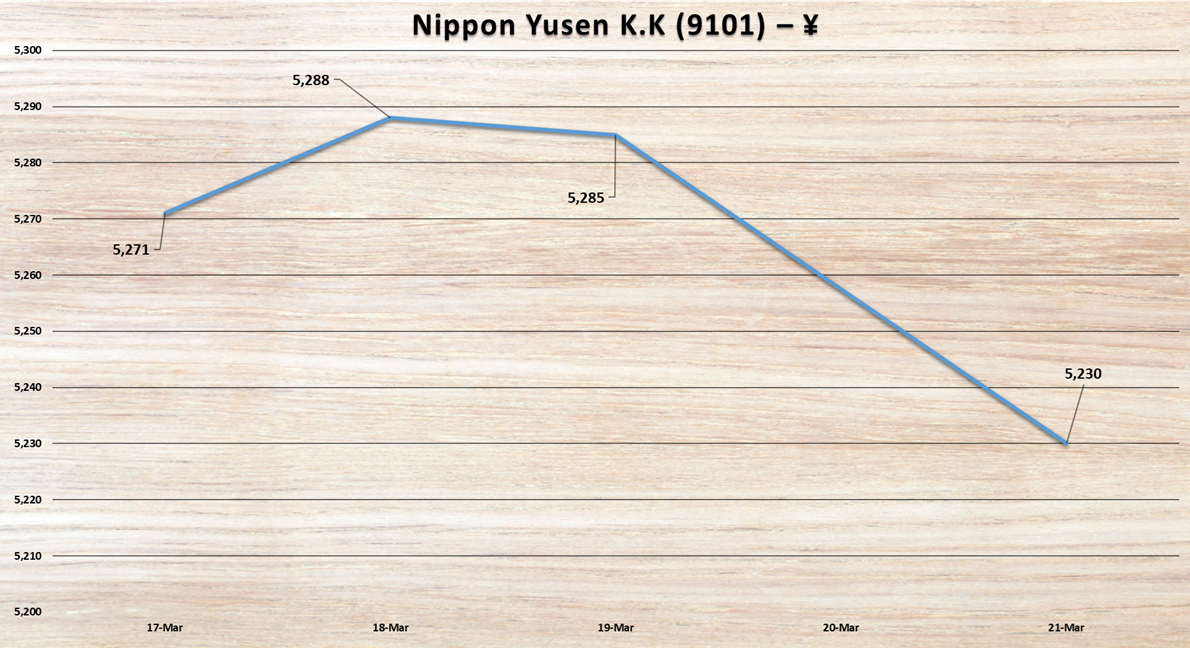

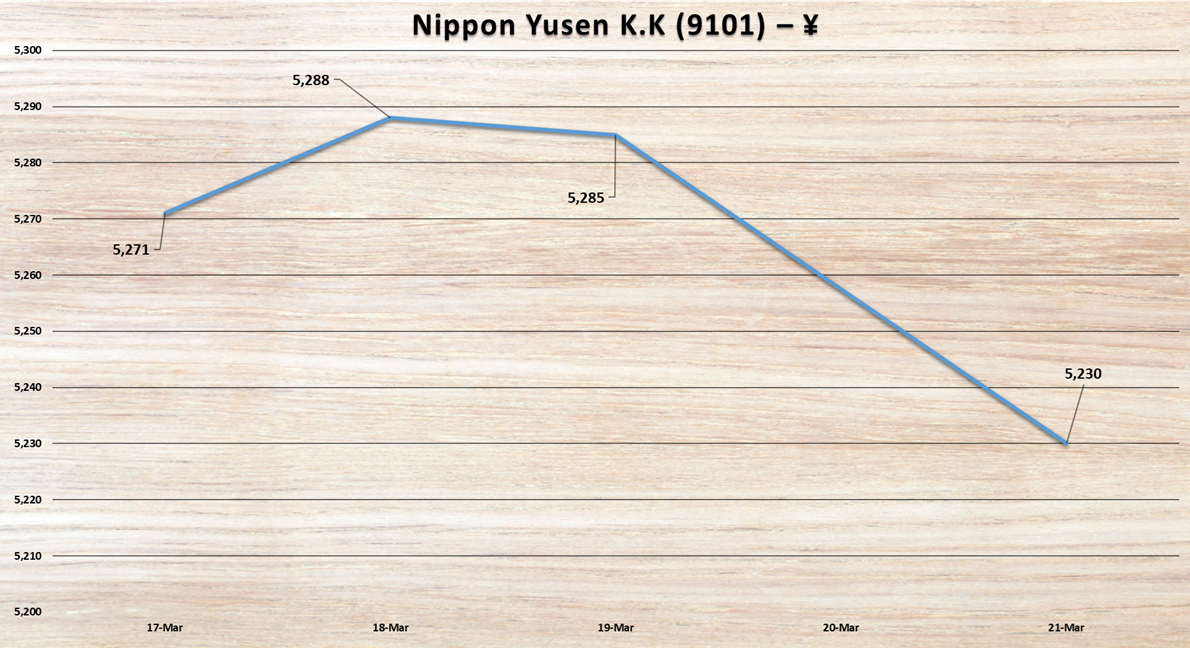

- Nippon Yusen K.K (9101)

- Ningbo Ocean Shipping Co Ltd (601022)

Ningbo Ocean Shipping Co Ltd (601022) demonstrated relative stability, closing at ¥8.54. The company’s performance is closely tied to China’s trade dynamics and the demand for intra-Asia shipping services. As a key player in the region, Ningbo Ocean Shipping benefits from its strategic positioning and ability to capitalize on regional trade flows. However, its outlook remains influenced by broader economic conditions, including shifts in global trade patterns and regional market demand. While the stock has shown resilience, its future trajectory will depend on how effectively the company navigates these external factors and maintains its competitive edge in the intra-Asia shipping sector.

- HMM Co Ltd (011200)

HMM experienced a decline in its share price, dropping from ₩20,850 to ₩19,840. The stock continues to face challenges, primarily driven by softer freight rates and heightened competition in the shipping industry. These factors have weighed on investor sentiment, creating pressure on the company’s valuation.

Despite these near-term headwinds, HMM remains focused on its long-term strategy of fleet optimization, aiming to enhance efficiency and competitiveness. While the current market conditions pose difficulties, the company’s efforts to modernize and streamline its operations could position it for recovery and growth once industry dynamics improve. Investors are closely monitoring how HMM navigates these challenges while executing its strategic plans.

The container shipping market saw a highly mixed performance this week, with notable fluctuations across major shipping companies. While some carriers capitalized on market conditions to post strong gains, others faced significant losses, reflecting the ongoing volatility in global shipping.

Top performers included Ningbo Ocean Shipping Co Ltd (NBOS) (+3.69%) and The National Shipping Company (+4.90%), which led the week’s gains, showcasing strong momentum. Danaos Corporation (+4.57%) also recorded a solid rise, benefiting from its position in container ship leasing. Moderate gains were seen in Wan Hai (+2.09%), Yang Ming (+1.58%), and MOL (+1.56%), suggesting that select regional players navigated the market effectively.

On the other hand, Hapag-Lloyd (-6.21%), Maersk (-7.36%), and MPC Container Ships (-5.28%) suffered steep declines, indicating pressure on global shipping giants. ZIM (-2.50%), SITC (-1.70%), and Evergreen (-0.87%) also trended downward, signaling cautious investor sentiment in the sector.

Beyond company performance, global geopolitical tensions continue to shape the shipping industry. Disruptions in the Red Sea, coupled with ongoing instability from the Russia- Ukraine war, have added uncertainty to trade routes, increasing costs and delays. Additionally, potential U.S. tariffs on Chinese imports could further impact container demand, as trade restrictions may shift supply chain strategies.

This week’s container shipping market data paints a picture of a sector in transition. While certain companies, particularly regional players and leasing firms, found opportunities for growth, larger operators struggled amid shifting supply chain dynamics, economic headwinds, and geopolitical risks. As the industry continues to adjust, the coming weeks will be crucial in determining whether these trends persist or if a broader recovery takes shape.

![]()

The post Container Shipping Market: Weekly Analysis appeared first on Container News.

Content Original Link:

" target="_blank">