Global Bunker Indices edge lower in week 41

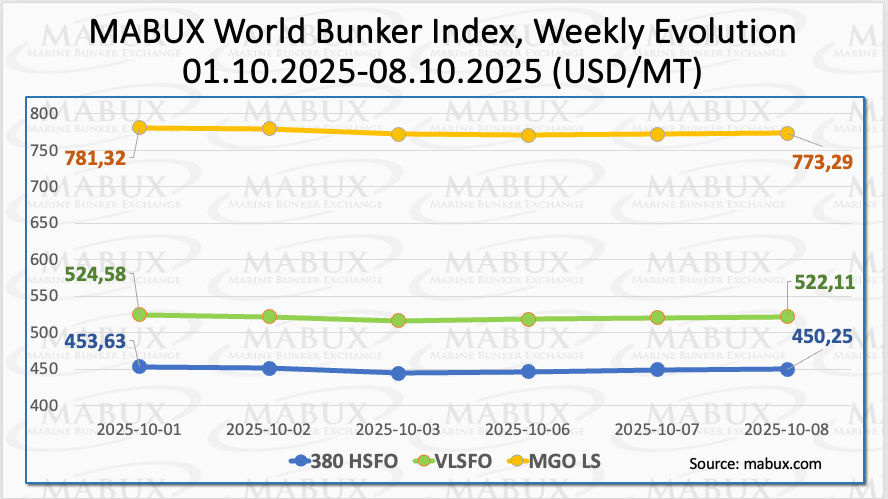

Following the 41st week, the global bunker indices of MABUX posted a moderate downward adjustment. The 380 HSFO index declined by US$3.38, moving to US$450.25/MT, once again nearing the US$450 threshold.

The VLSFO index fell by US$2.47, to US$522.11/MT, while the MGO index registered the sharpest decline of US$8.03, sliding to US$773.29/MT. At the time of writing, early signals of an upward correction were visible across the global bunker market.

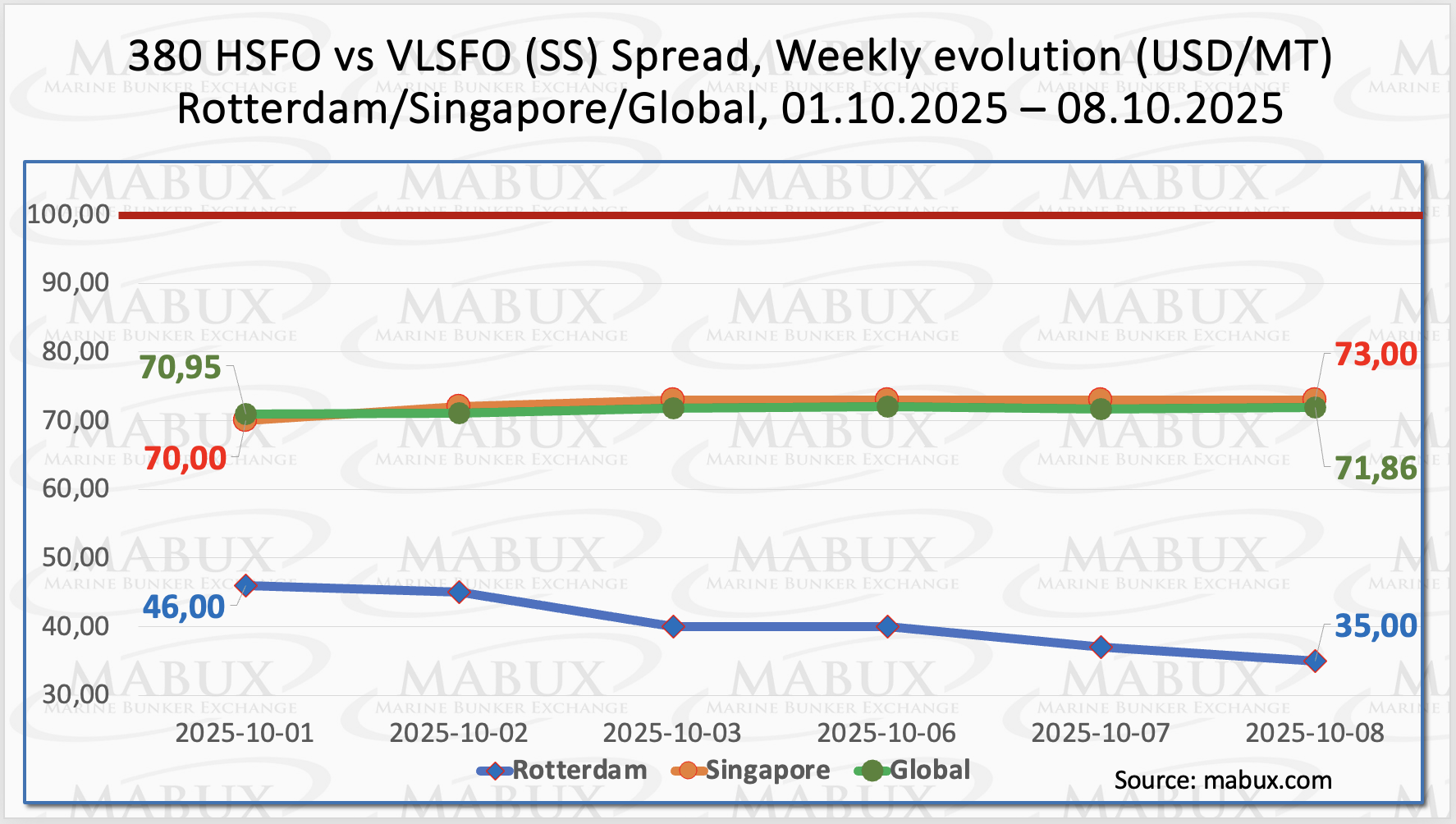

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—showed a slight increase of US$0.91, rising to US$71.86, while remaining firmly below the psychological mark of US$100.00 (SS Breakeven). In contrast, the weekly average value of the index decreased by US$1.76.

In Rotterdam, the SS Spread continued its downward movement, falling by US$11.00 to US$35.00, breaking the US$40.00 threshold for the first time since May 8, 2025. The weekly average value at the port also declined by US$5.67. In Singapore, the 380 HSFO/VLSFO price difference widened by US$3.00, to US$73.00, with the weekly average value also rising by US$3.00.

Overall, the SS Spread indices continue to lack a clear trend. However, the values remain well below the US$100.00 mark, sustaining the higher profitability of conventional VLSFO compared to the HSFO plus scrubber combination. Significant shifts in SS Spread trends are considered unlikely in the near term.

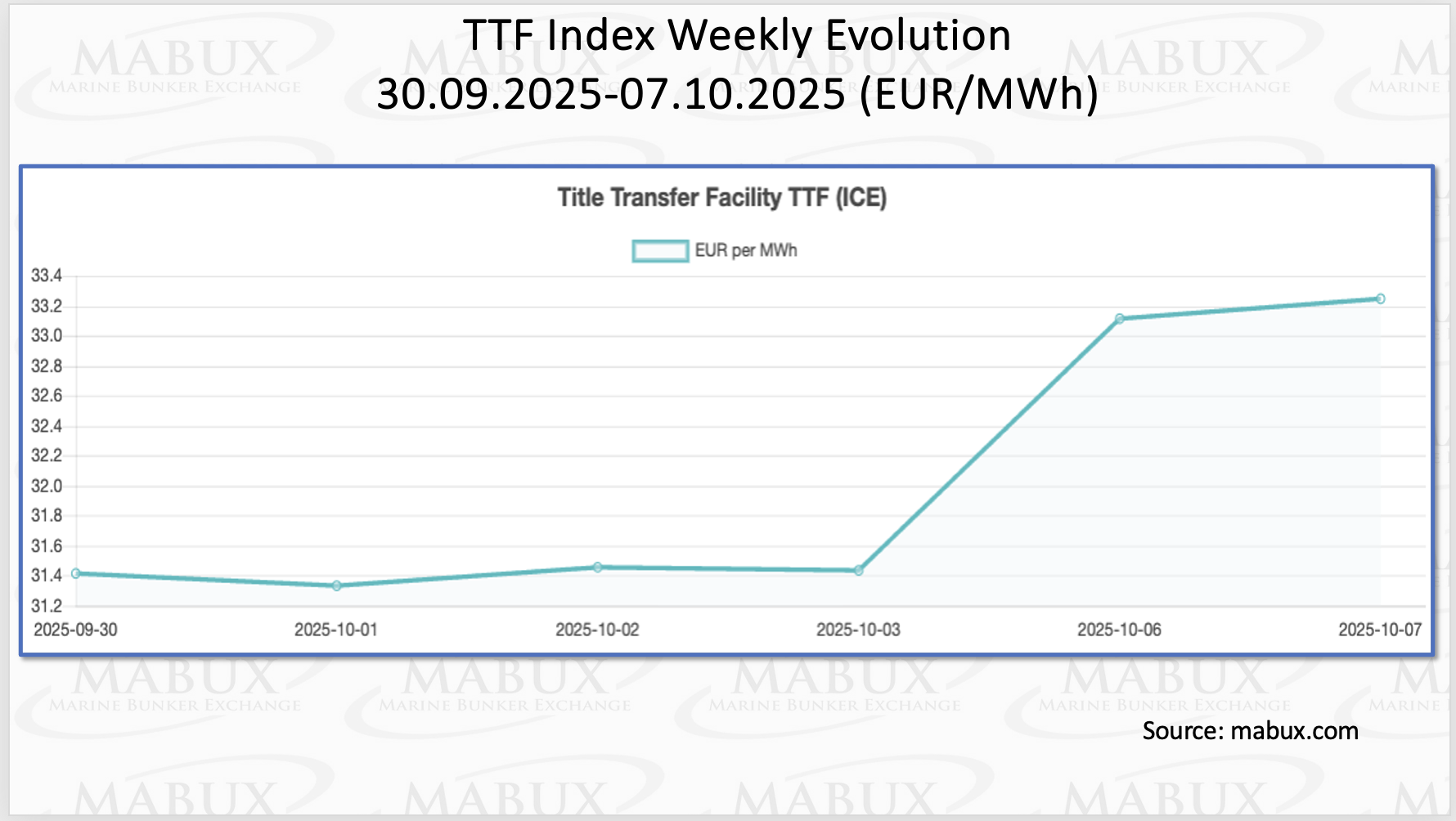

Europe is relying on LNG imports to offset reduced pipeline flows and rebuild storage, but inventories remain below last year’s levels. With TTF prices still trading above 2024 benchmarks on a year-over-year basis, the market remains exposed to supply shocks and weather volatility—even as overall EU demand holds steady.

As of October 7, European regional gas storage facilities were 82.88% full, up 0.29% from the previous week. Storage levels stand 11.55% higher compared with the beginning of the year (71.33%), although the pace of injections has slowed noticeably. By the end of the 41st week, the European TTF gas benchmark resumed its upward trajectory, gaining 1.835 euros/MWh to reach 33.346 euros/MWh from 31.411 euros/MWh a week earlier.

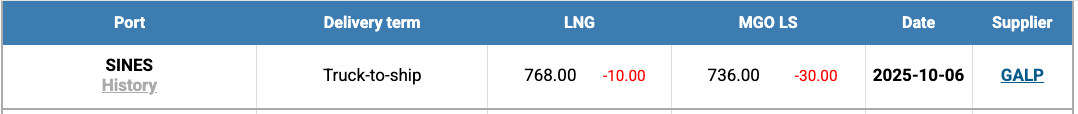

The price of LNG as a bunker fuel at the port of Sines (Portugal) declined by USD 10.00 this week, standing at US$768/MT, compared with US$778/MT the previous week. At the same time, the price differential between LNG and conventional fuel once again moved in favor of conventional fuel: US$32/MT, down from US$11/MT in favor of LNG a week earlier. MGO LS was quoted at US$736/MT at the port of Sines on the same day.

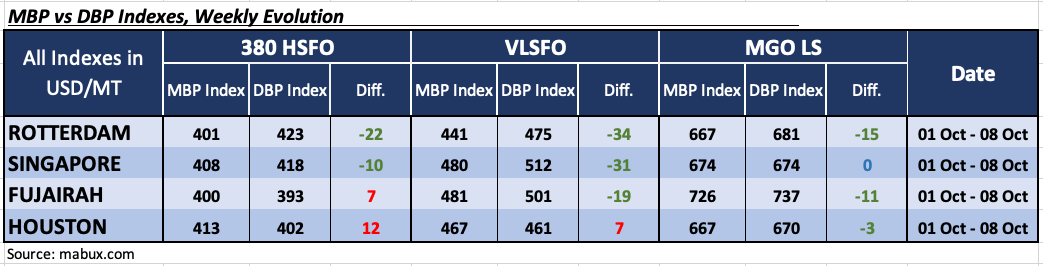

At the end of the 41st week, the MABUX Market Differential Index (MDI)—the ratio of market bunker prices (MBP) to the MABUX digital bunker benchmark (DBP)—reflected the following price dynamics across the world’s largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: Fujairah and Houston moved into the overvalued zone, with their average weekly MDI values rising by 20 and 17 points, respectively. Rotterdam and Singapore remained undervalued, although their discounts narrowed by 11 and 10 points. Notably, Fujairah’s MDI approached the 100% correlation mark between MBP and DBP.

• VLSFO segment: Houston was the only port in overvaluation, with its average MDI adding another 4 points and remaining close to full correlation. The other hubs maintained their positions in the undervalued zone. Weekly average MDI levels fell by 7 points in Rotterdam, 18 points in Singapore, and 17 points in Fujairah.

• MGO LS segment: Singapore’s MDI reached full 100% correlation between MBP and DBP, while the remaining ports stayed undervalued. Weekly MDI values decreased by 18 points in Rotterdam, 20 points in Fujairah, and 10 points in Houston, with the latter also nearing full correlation.

”Last week, the balance between overvalued and undervalued ports shifted toward overvaluation. The MDI reflected overpricing at two ports—Fujairah and Houston—in the 380 HSFO segment, while Singapore reached full 100% correlation in the MGO LS segment. We believe the gradual shift in the SS Spread’s focus toward overpricing is likely to persist into next week”, commented Sergey Ivanov, Director, MABUX.

”We believe that, despite the slight decline in indices at the end of the week, bunker prices may in the short term enter a phase of moderate upward correction”, added Ivanov.

The post Global Bunker Indices edge lower in week 41 appeared first on Container News.

Content Original Link:

" target="_blank">