UBS, Rand Merchant Bank lead financial adviser M&A rankings in MEA for H1 2025

UBS and Rand Merchant Bank have emerged as the leading financial adviser for mergers and acquisitions (M&A) in the Middle East & Africa (MEA) during the first half of 2025, according to the latest league table published by GlobalData, a data and analytics firm.

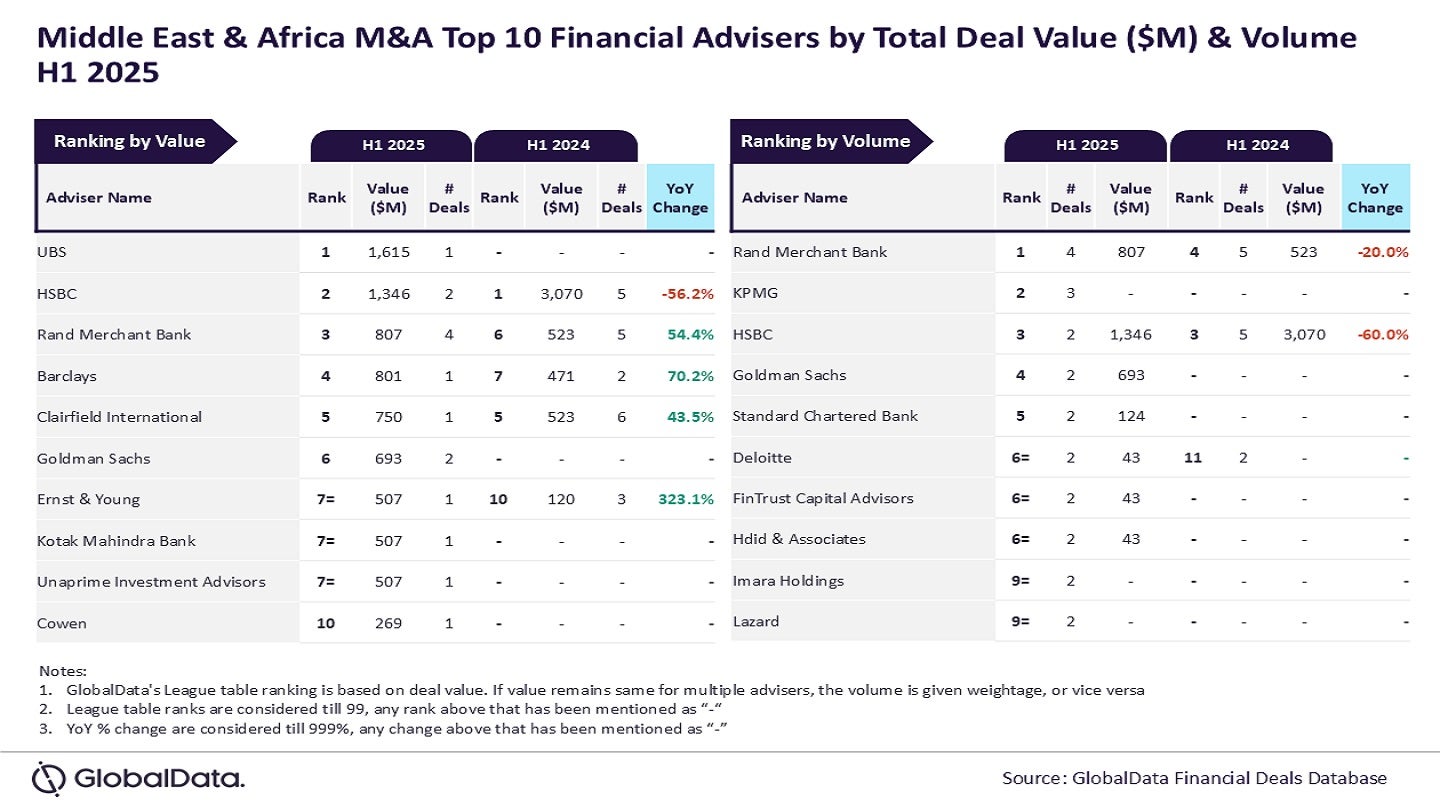

As per GlobalData’s Deals Database, UBS topped by value, with $1.6bn in advised deals, while Rand Merchant Bank led by volume, with four deals to its credit.

Go deeper with GlobalData

The leading position of UBS has been attributed to its advisory role in the $1.6bn Warba Bank-Alghanim deal.

GlobalData lead analyst Aurojyoti Bose said: “UBS, which led by value in H1 2025, was not even among the top ten by this metric in H1 2024. Involvement in only one but a big-ticket deal helped it top the chart by value.”

Rand Merchant Bank not only led by volume but also ranked third by value, showing a notable improvement from the fourth position in the previous year.

Bose added: “Rand Merchant Bank saw its ranking by value improve from the fourth position in H1 2024 to the top position in H1 2025. Apart from leading by volume, Rand Merchant Bank also occupied the third position by value.”

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe second place by value was secured by HSBC, with advisories on deals worth $1.3bn.

It was followed closely by Rand Merchant Bank at $807m, Barclays at $801m, and Clairfield International at $750m.

In terms of volume, KPMG took the second spot with three deals, with HSBC, Goldman Sachs, and Standard Chartered Bank each advising on two deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.

Content Original Link:

" target="_blank">