Anthropic Is Now a Top Broadcom Customer According to Analysts. Should You Buy AVGO Stock?

Broadcom’s (AVGO) mystery $10 billion customer could be Anthropic – an AI startup best known for developing the Claude family of large language models (LLMs) – according to a Mizuho analyst.

The firm’s research note arrives only days after AVGO announced a sizable deal with OpenAI, but said the company behind ChatGPT isn’t the unnamed customer referenced on its Q3 earnings call.

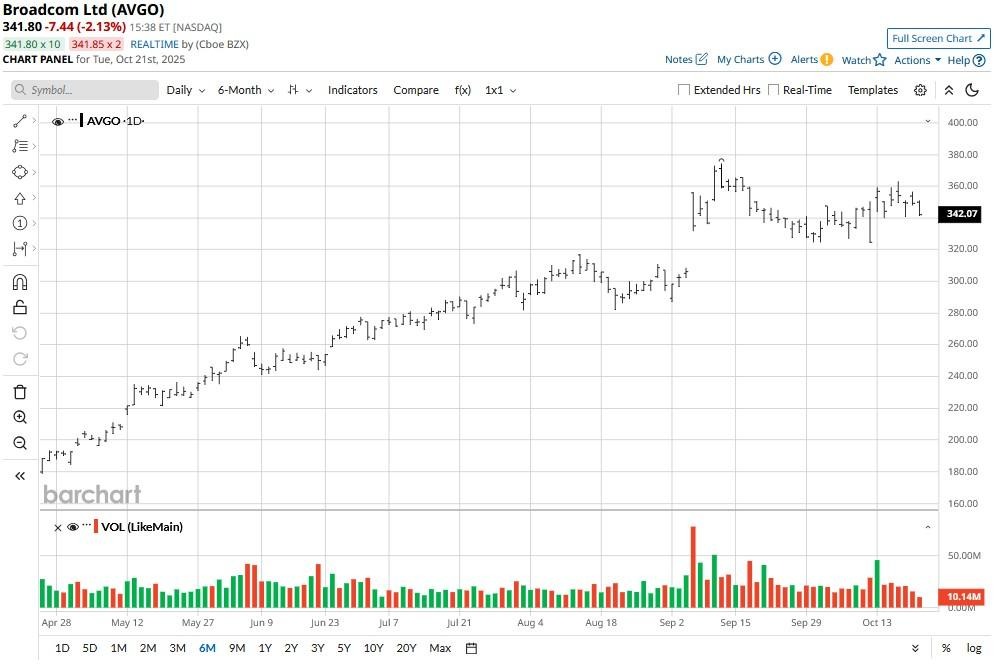

At the time of writing, Broadcom stock is up a whopping 145% versus its year-to-date low in April.

Why Is the Anthropic Partnership Significant for Broadcom Stock?

Broadcom already has an impressive lineup of artificial intelligence customers including Google (GOOGL) and Meta Platforms (META).

But landing Anthropic as one would still be a major win for AVGO stock given its exciting growth trajectory. The startup’s revenue is expected to hit $7 billion this month and surpass $20 billion in 2026.

The strategic importance of a potential partnership with Anthropic made Mizuho’s senior analyst, Vijay Rakesh, maintain his “Outperform” rating on Broadcom shares in a research note on Tuesday.

Rakesh now sees the semiconductor stock rallying to $435 over the next 12 months, indicating potential upside of another 30% from current levels.

AVGO Shares to Rally as AI Revenue Continues to Increase

A recently announced agreement with OpenAI and expectations of Anthropic being the $10 billion customer made Rakesh raise his AI revenue estimates for Broadcom on Tuesday.

In 2026, he now expects the company to see about $41 billion in artificial intelligence revenue, which he believes will more than double to $82.7 billion in fiscal 2028.

Rakesh’s projections reflect growing confidence in Broadcom’s ability to scale its AI chip offerings and maintain its competitive edge in the market broadly expected to be worth over a trillion-dollar within the next 10 years.

A dividend yield of 0.69% was among other reasons cited for the positive view on AVGO shares.

How Wall Street Recommends Playing Broadcom

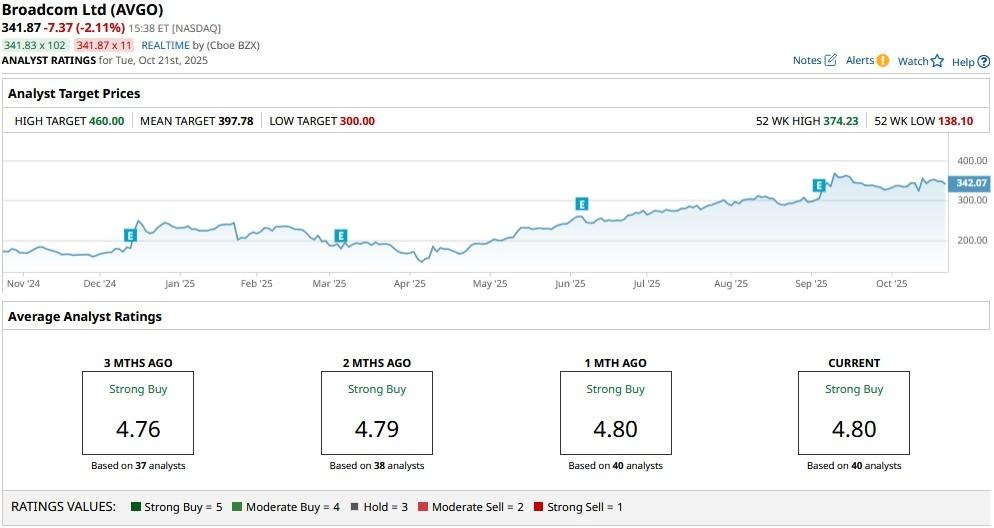

Other Wall Street firms also agree with Mizuho’s constructive view on Broadcom stock.

According to Barchart, the consensus rating on AVGO shares currently sits at “Strong Buy” with the mean target of $398 indicating potential upside of about 17% from here.

Content Original Link:

" target="_blank">